Understanding your Shopify Customer Lifetime Value (LTV) is important if you want to strategically stay profitable.

It’s a key metric that shows what a customer is worth to your business throughout their entire relationship with you. Right now, we’ll explain the process of calculating LTV on Shopify and explore its relationship with customer acquisition cost (CAC).

What is Shopify Customer Lifetime Value?

The Shopify Customer Lifetime Value is the total revenue a customer will generate during their time with your business.

This metric accounts for the average purchasing behaviors, increasing it’s accuracy and letting you know who to target.

Calculating LTV involves three pieces: the average order value, the frequency of purchases, and the customer lifespan. When combined, these elements paint a picture of customer value, providing insights of the health of your business.

While Shopify doesn’t exactly show LTV, it provides the tools you need to calculate it.

Calculating LTV involves three pieces:

Let’s do an example.

Customer A has the following

- Average Order Value: $75

- Purchase Frequency: Once a month

- Customer Lifespan: 24 months (2 years)

Customer Lifetime Value: 75 (AOV) * 1 (PF) * 24 (CLS) = $1800

This is the common way. However, a more complex formula that gives you a more accurate value is:

LTV = ( Total Sales ) + ( (Average Order Value) * (Median Number of Orders) * (Average Tenure – Current Tenure) )

You can actually make this more complex to get an even better value, but at that point its taking too much time that you could spend perfecting your products.

This is why people just use an analytics app to shorten the time it takes, and also to have the heavy-lifting done for them.

Why Knowing Your Shopify Customer Lifetime Value is Important

I’m certain you work hard on your store everyday.

It’s hard to work on a store day-in and day-out, trying everything you can to ensure your store does well.

Are you getting enough traffic? Have the competitors found a new way to gain more paying customers? What about your Return Rate? Are customers even coming back once they’ve bought from your store?

All these questions shoot around in your head when you know you’re building something great. It’s completely normal to think this.

But it’s also important to know what the customer thinks about your product. If there isn’t a high Customer Lifetime Value, it shows the people don’t like what you got.

You know what a high LTV means? Your customers are loyal to you

Here’s something interesting:

- Bain and Company found that customers with a high LTV spend more in their third year as a customer than their first.

- One study from Adobe found that 40% of your revenue comes from 8% of customers

Want to know what else these loyal customers can do? Tell other people about your products.

Also known as: FREE MARKETING

- Wharton School of Business found that referred customers have a 16% higher LTV than non-referred

- Referred customers are 4x more likely to buy than non customers.

Focusing on increasing your Shopify LTV means creating a better experience for your customers which does nothing but reel in even more loyal customers.

Having customers is great. But if you can’t keep them, what’s the point of even having a store?

By the Numbers

Empower your business with our Shopify Data Driven App

- ✔ Know Your Audience Behavior

- ✔ Deep Customer Segmentation

- ✔ Retarget With Integrations

- ✔ All The KPIs & Reports You Need

How to Increase LTV

Segment your Customers

Your customers are not all the same. Thinking they are will bankrupt your business.

People have different needs. They desire different things from you. You can provide it all for them. But you need to understand them.

This is why segmentation is so important. This is why big stores look to find apps that segment their customers for them so they can understand their customers better.

The reasons why so many stores still don’t segment their customers comes down to two things.

- It takes a lot of time and money to do it on their own (understandable)

- They don’t even know apps like By the Numbers can do this for them for less money (than if they did this on their own), and get them more value and information on their customers.

Segmenting your customers means you can group people based on their behaviours. Once you do this, you find out which type of marketing resonates with them.

If you have two customers, one that just bought from your store, and another that’s been loyal for 3 years, wouldn’t you speak differently to them?

Of course you would. The knowledge gap of products between the new and loyal customer is so large. You have to catch that new customer up to your loyal one.

You know what also happens when you segment those customers? On a good analytics app, they’ll show you the unrealized sales.

This is the amount of sales that this segment is still willing to spend.

Through proper marketing and retention, you’ll easily get these sales.

Talk to These Segments

By now, you would’ve guessed that the common trend here is communication.

You just need to know how to understand your audience. But once you do, where do we go from there? We talk to them.

Email marketing is a great way to do this. Klaviyo is the best email marketing platform to use to talk to your customers. The best part about klaviyo is that you can import your segments from By the Numbers to Klaviyo so that you can set up your sequences that much easier.

When it comes to talking to your consumers, here’s an example of speaking differently to different segments:

Let’s take a recent customer. If they just recently bought from our store, they would need a little bit of a push to come back.

They don’t know you that well. It’s normal.

So how do we get them to come back?

One way is through a promo. Promos are always great for making customers come back to the store and potentially buying.

You can also give a thank you email for purchasing. A personalized one that is. People who feel emotionally connected to a brand are likely to buy again from your store.

The idea here is that you need to build that relationship with them. Financial incentives usually help more here.

Let’s take a loyal customer. How do you speak to them differently than the recent customer?

These customers don’t need financial incentives to return. They already love you. You can instead give them personal recommendations. If you see they buy a certain type of product, let them know new ones have just arrived.

It doesn’t seem like much at first, but doing this over the long term (especially with bigger audiences) is going to grow into something great.

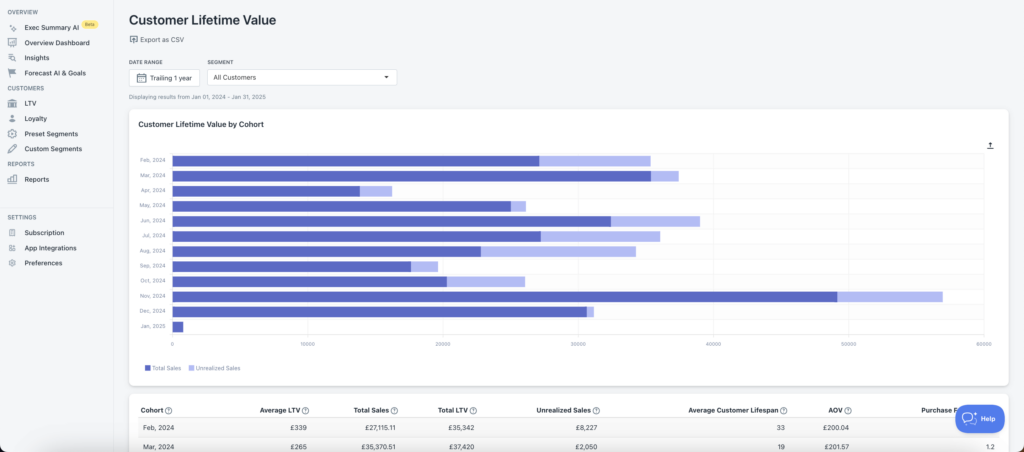

How to Use By The Numbers To Analyze Customer Lifetime Value

By the Numbers simplifies LTV calculation in Shopify. This app provides accurate data on customer LTV, Cohort Retention rates, and Product Repurchase rates, providing data-driven decisions.

Calculating the LTV shows the complete value of a customer cohort. Then, you can see the ROI of marketing campaigns for customer accquisitions.

After obtaining the ROI, you can compare it with other marketing campaigns or monitor it over time to keep track of changes.

Here’s how you can begin tracking LTV with the help of By the Numbers:

1. To Access the LTV Report, Navigate to the Left-Side Menu and Select LTV.

The report should then be displayed on your screen:

This report provides you with several crucial pieces of information, including:

- Monthly Cohort: A group of customers who made their first purchase in a particular month.

- LTV: (Current Value) + (Future Estimated Value)

- Actual Value: Total sales for this cohort to date.

- Predicted Value: Estimated future sales for this cohort.

- Customer Return Rate: The percentage of customers that returned within a specific timeframe.

- Average Lifespan: The expected average lifespan of a cohort in months.

- Average Order Value (AOV): The total sales divided by the number of orders.

- Order Frequency: The average number of orders placed by the cohort in a given month.

2. To View the Segments, go to the Left-Side Menu and Select Segments.

The menu for segments should now be visible on your screen:

In addition to the typical details of a Segment such as AOV and Order Frequency, we now provide the Average LTV. This metric shows the amount of money the average customer in that Segment is spends during their customer lifetime. Conversely, Customer Value shows you how much money the average customer in that Segment has spent with your store.

3. Click on the “View Customers” Link Under Any Segment to Get a Report that Shows the Customer’s Data for that Segment.

You should see something similar to this:

In addition to their total sales, customer details now include each individual customer’s LTV. The LTV represents the expected amount a customer will spend while total sales show how much they have already spent with your business.

4. Generate a Custom Segment Utilizing LTV

While generating a custom Segment, you can select LTV from the Filters dropdown. You should see something like this:

With this feature, you can now filter for customers who have a Total Lifetime Value (LTV) that is above or below a specific amount that you decide on.

5. Click on “Loyalty” From the Navigation Menu on the Left-Hand Side

A screen similar to this should appear:

Each loyalty square displays the LTV for the corresponding group of customers. This LTV value represents the average amount that the current group of customers is predicted to spend with your business.

Conclusion

Knowing your Shopify customers’ LTV is essential to make data-driven decisions and optimize your business performance. It’s important to know your Shopify customers’ LTV, and with By the Numbers, it’s easier than ever.

By the Numbers

Empower your business with our Shopify Data Driven App

- ✔ Know Your Audience Behavior

- ✔ Deep Customer Segmentation

- ✔ Retarget With Integrations

- ✔ All The KPIs & Reports You Need